A guide on how to file nil Tax returns for the unemployed or students who have no income to declare for the year of tax. That is the tax for the period of 1st January to 31st December of the previous year.

Did you know that if you don’t file KRA tax return form whether you are employed or not you will be fined ksh. 20,000? This is not a one-time fine and yet you can avoid it.

Below is a step-by-step guide on how to go about it and avoid unnecessary fines if you are jobless and at one point had acquired a KRA pin for HELB or other purposes.

Do I need to file returns if am unemployed?

Yes, PIN holders with no source of income need to file a Nil return.

Will I be fined if I don’t file returns for unemployed?

If you file the Nil Return for those who are not employed you will not be fined. But if you don’t no matter your employment status, you will be fined ksh. 20,000.

Can I file Nil returns if I am employed?

No, you will be penalized for that. You are supposed to submit your VAT returns as provided by your employer

Are students supposed to file KRA tax returns?

Everyone who has KRA pin is supposed to file returns. For students who got a KRA pin when applying for helb should just file nil returns. However, if you do not have a KRA pin you don’t have to file.

SECTION 1: How to file Tax returns for unemployed/students

Follow the steps below to file your tax return online;

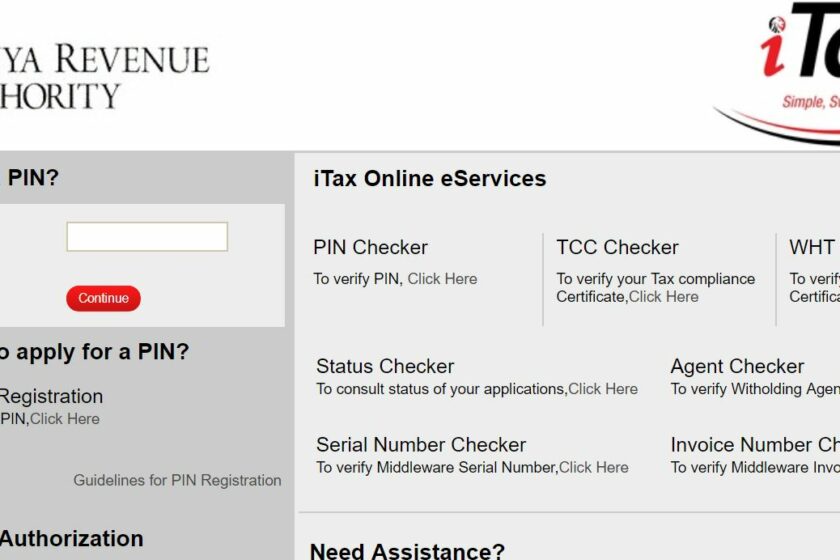

- Go to https://itax.kra.go.ke/KRA-Portal/

- Login with username and Password

- Go to Returns Page

- Click File Nill Returns

- Select Income Tax Resident

- Enter Returns Period

- Click Submit

- Download Your Receipt

- Details available in the next step

Step 1: Register with itax portal

Type https://itax.kra.go.ke/KRA-Portal/ and you be directed to the KRA portal where you will enter your KRA Pin or USER ID. Enter and log in with your iTax password. If you have forgotten your password, retrieve one using the “FORGOT PASSWORD‟ option on the bottom right of the iTax portal page.

Step 2: On itax portal go to returns

After Login. You will be directed to a page that has a red top menu as shown below.

Place your cursor (mouse pointer) on the ‘RETURNS” page and a drop-down menu will appear. Below the drop-down menu you will see “FILE NILL RETURNS.” For the unemployed that is where you are supposed to click and you will be directed to a page that looks like the one below.

Fill in by entering:Tax obligation: Income Tax-Resident Individual

Then click Next and you be directed to a page like this below

Fill in by entering:

- Wife Pin: (Leave blank if you don’t have one filing returns)

- Return Period: 01/01/2022

- Return Period: 31/12/2022 (this section will fill itself automatically once you click the small calendar on the right)

Click Submit. On successful submission, the message below will be displayed:

Click download Returns Receipt to download. You are done after downloading.

SECTION 2: How to file income tax returns for employed

Filing Of Income Tax Individual Return For the Employed procedure is provided in the video below.

Related: Student tax filing procedure

Leave a Reply