Below is a guide on how campus students should file KRA Income Tax returns as Nil if unemployed. If you are studying and employed, you should file your income returns to avoid fines and penalties.

Should Students File KRA Income Tax Returns?

Yes, everyone with a KRA pin should file returns. Tax returns are only filed for the year ended. For example, if you are filing your returns in 2024, they should be from January 1, 2023, to December 31, 2023 as provided in the tutorials below.

Failure to file returns attracts a penalty of Ksh. 20,000 every year.

Kra Tax Waiver for student

It is recommended that you file tax returns in time. That is before the end of June of every year. However, if there are circumstances that made you not file tax returns in time, you can apply for a student Tax Waiver. KRA can reject or approve your tax waiver application depending on the reasons you gave.

How students should file Nil KRA Income Tax Returns (Procedure)

Follow the procedure below to file your returns if you are a student.

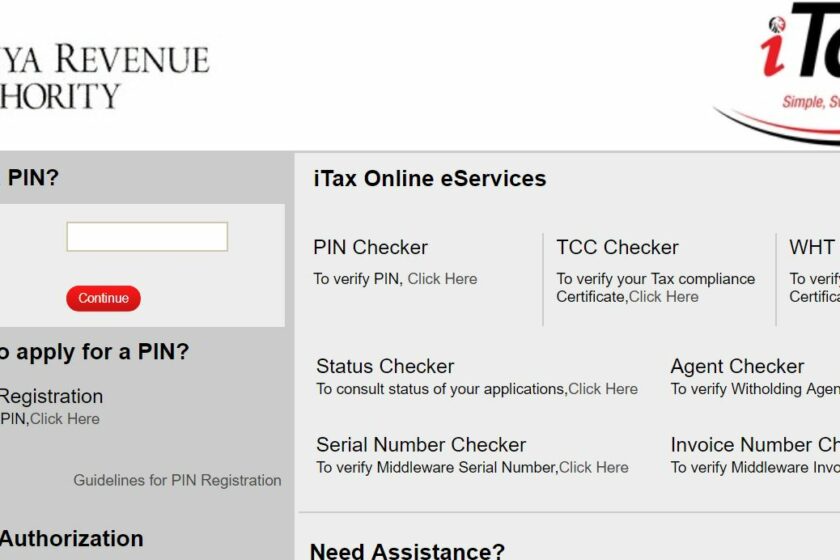

Step 1: visit KRA Itax Portal

The KRA itax portal website is: https://itax.kra.go.ke

Log in with your KRA pin and password. You can reset your password if you have forgotten yours. It takes time for the reset password instructions to arrive in your email. If you have forgotten your email, scan your ID and send it to KRA via email (callcentre@kra.go.ke), kra Facebook page inbox or twitter inbox. (Use Twitter or Facebook for a quick response).

Step 2: Select your Profession

A pop-up will appear which will ask you to select your profession. Now that you are not employed and are still studying;

- select STUDENT

- then your level of studies (Certificate, Diploma, Degree, Masters, Ph.D. e.tc).

Step 3: Go to KRA Returns page

On the top of the website select Returns, then File Nil Returns.

Step 4: Fill Nil e-return form

On the Nil e-return form;

- Select self

- Then fill your KRA pin

- Then on Tax obligation enter Income Tax-Resident Individual

Step 5: Enter Tax File Period, Year

This section will auto-refill itself. The year should be from the 1st of January of the previous year (for example 01/01/2022 ) to 31 of December (For example 31/12/2022).

Then Submit.

Once you click submit the message in step 6 will display.

Step 6: Download KRA Tax Income filing acknowledgment receipt

Be sure to download the KRA acknowledgment receipt as you may need it in the future.

Do not miss all our latest updates on kra tax filing and new tax laws that affect students. Subscribe below.

Leave a Reply