Every person who owns a company in Kenya is required to register for beneficial ownership information. The deadline for registration is 31st January 2021. Registration can be done online; we have provided the procedure below for existing companies. (NOTE: Deadline has been extended to 31st July 2021)

What is Beneficial Ownership Information?

Beneficial Ownership information is a regulation that requires companies registered in Kenya to provide shareholder information. Some of the information needed when registering as beneficial owners include full names, ID number, ID number, date of birth, business address, phone number, email address, percentage of shares, etc.

Read more about Beneficial ownership information act of 2020 (pdf).

How to register for Beneficial Ownership information

The process of registering for beneficial ownership information is simple and can be done online via brs eCitizen portal using the step-by-step procedure provided below.

- Visit eCitizen portal and login or register: ecitizen.go.ke.

- In your dashboard, click on Business Registration Services.

- If asked to login, do so again.

- Go to Business

- If your B.O. Status is pending, then you need to provide your information.

- Click on View.

- Then at the top menu, click maintain a company

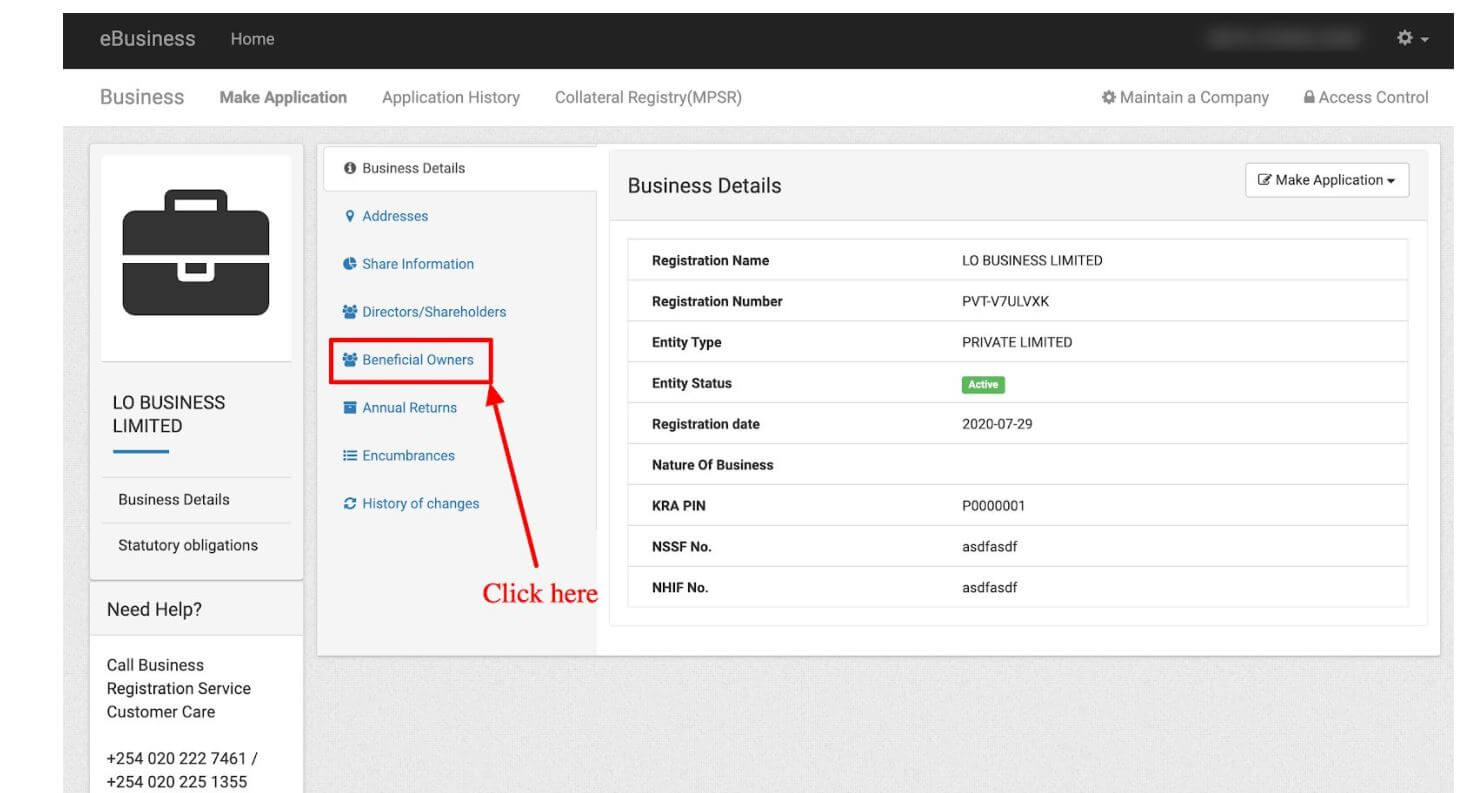

- Click on Beneficial Owners Tab on the left

- Then on the right click Change Particulars (Change of Officials)

- Then Click Update BO (Beneficial Ownership) Tab

- Fill in all the details (total ownership, direct ownership, voting rights, influence in the company, residential address, date of becoming a BO)

- After you are done filling in all the details click Save

- Then click Save and Continue

- Fill in the required information in the form, sign, and upload the document.

- Click Save and Continue.

- Confirm that the information you have provided is correct and click Finish.

- You are done.

NOTE: If you have a company registered with KRA and is not active on brs.ecitizen.go.ke, then you need to link it to use the online service.

Penalties of not complying

If your company (any type of company that files kra returns) has not provided Beneficial Ownership information by 31st July 2021, it is liable to a fine of not more than Ksh. 500,000 and each shareholder of the company that has not provided his/her information is subject to a fine not exceeding ksh. 50,000.

Leave a Reply