Learn about some of the factors that mobile loan apps use to calculate your Credit score rating before they set a loan limit, reject or issue you with a loan.

Mobile Lending Apps Phone Access Permission

Upon downloading a mobile loan app like Okash, Tala, Branch e.t.c, the following information is accessed if you grant permission;

- Names

- Age

- SIM card details

- Mpesa Phone Number

- Type or Make of Mobile Phone you are using

- Mobile Phone IMEI or serial number

- Network you are using (Safaricom, Telkom, Airtel e.t.c)

- Mpesa Transactions logs

- Browsing history

- Mobile Apps installed in your Phone

- Phone Book Contact List

- call logs

- SMS logs

- GPS location (where you live)

- mobile money account details

- Photos, videos and any other digital content stored in your phone

- Facebook Friends (if you login with Facebook)

- e.t.c

As you can see, the loan app has access to almost everything in your device.

Once you grant access to the above information, the app will regularly be scanning your device data for any changes when you apply for a loan. Most of the information is scanned and processed using artificial intelligence and machine learning algorithms before your loan is disabused.

Some information collected from your device will be stored by the lending app in their servers even if you uninstall the app.

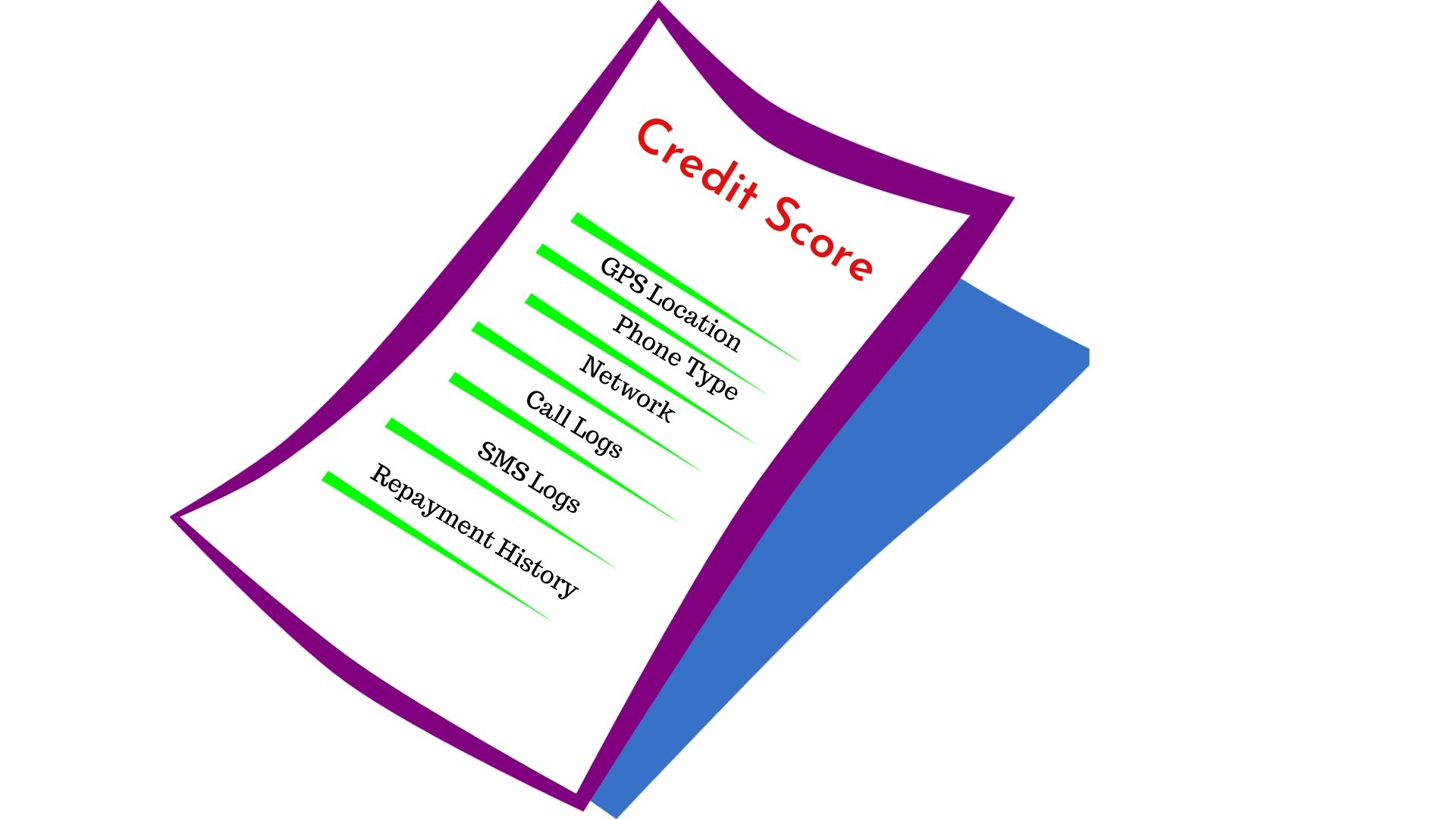

How information collected is used to calculate Your credit score

We are going to list some of the types of information collected from your smartphone that betrayed you, leading to loan application rejection:

- Loan Repayment History: How often do you repay your loans and whether you have ever defaulted. Loans default means low credit score.

- Mpesa Transaction sms logs: They will dig deep into your financial background by checking your sms on mpesa transactions and balances and whether you have ever taken any loan. Few mpesa transactions means low credit score

- Apps: They will check the number of mobile loans you have installed and what you use them for.

- Mobile Banking: This will be used to determine whether you are unbanked or have a bank account and how you engage in banking activities.

- CRB: Some apps will check with credit reference agencies like Metropol on your lending and loan repayment history to determine whether you are a good borrower or bad borrower.

- Location: They will check where you are situated and compare the repayment history of other customers from that location. The poverty index of a region plays a slight role in Credit scoring.

- Contact List: They will scan through your contact list to check whether you have good friends. If your contact list is full of people who have been defaulting on loans then that counts in your credit risk score.

- Browser and Digital Content: They will minimally use any digital content in your phone and browser to get a view of what activity you are engaged in. This information will then be used to determine your risk score.

- SMS and Calls Logs: How often you make and receive calls, send and receive sms messages are also used to determine your credit score. Be aware also that the time you make calls also affects your credit worthiness.

- Type of Phone or make: A cheap phone is not necessarily related to poverty levels but it can be used to determine whether you are in a position to pay that kind of loan you want to borrow. Phone type or make mostly affects loan limit.

NOTE: Loan Lenders do not rely on a single source of information to evaluate creditworthiness.

How Credit scoring works

Scores are given against each information collected . For instance, you might score CRB; 8, Loan Repayment History; 5, Mpesa logs; 2, App logs; 4, Location; 3 and Contact list; 2.

All these credit information scoring, and some that I have not listed, is then combined to determine your credit score which will in turn help the lender make a decision on whether to to reject or approve your loan application.

You may have a good loan repayment history but other scoring factors like Sms logs score may be low thus pulling down your overall credit score leading to loan rejection.

TAKEAWAY: Be aware that much of your life can be scrutinized from your smartphone usage. Your smartphone is an extension of who you are, what you are worth and what you do. It can be used by a lender to determine your creditworthiness.

Leave a Reply