Okash App offers loans to Kenyans via Mpesa. Below is how to Download app, apply and get Okash loans. Once approved, Loans are disbursed instantly into your account.

About Okash App

Okash is a micro lending facility that is owned by the Opera group. The same company that owns opera mini browser. It offers unsecured mobile loans to Kenyans. Since it was launched in 2018, Okash has had steady growth.

What makes Okash standout compared to its competitors like Tala and Branch is that it has the highest maximum load limit. With Okash, you can borrow from Ksh. 1,000 to 500,000 depending on your loan Limit and credit score. However, be aware of its strict Terms and Conditions.

Okash uses your device data, mpesa transactions, loan repayment history e.t.c to measure and increase your credit score. The higher your credit score, the higher the loan you can borrow.

As at writing this articles, Okash Android app had over 1 million downloads and a star rating of 4.1 out of 54,177 reviews.

Requirements of getting Okash Loan

Applying for Okash Loan only requires you to be over 20 years, have a national ID card and be an active mpesa registered use.

You may be denied a loan even if you meet the above requirements if you have a low credit score.

NOTE: You will be required to provide a referee and their contact details, your employment status, and your marriage status.

Okash Loan Interest Rates and fees

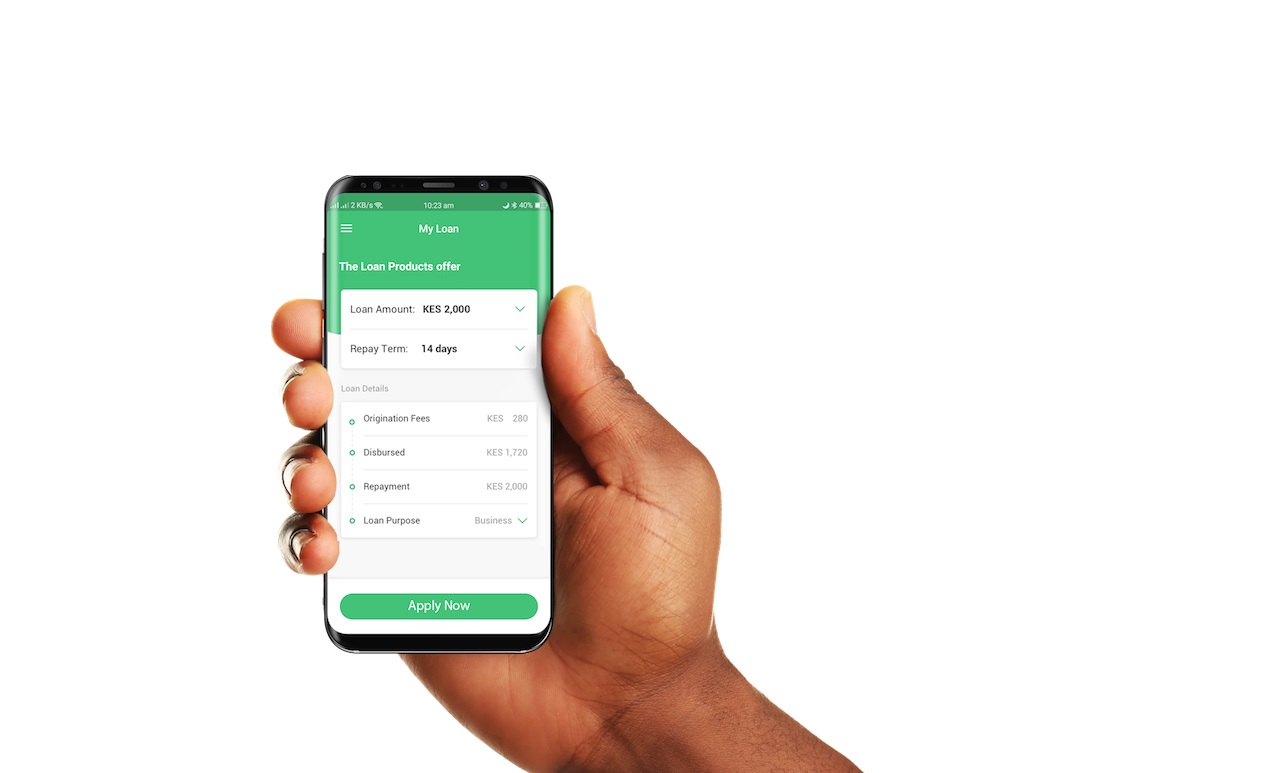

Okash App charges an interest rate of 14% for loans that take 14 days to repay and 16.8% for loans that take 21 days to pay.

Delay or late loan repayment attracts a daily rollover fee of 2% of the loan you took.

How to Apply for Okash Loan

To download Okash App, follow the procedure below;

- Visit Google Play store: Okash App Loan

- Download, Install the App and register by filling in the many required details (other apps like Timiza do not need that much information)

- Once you are done with registration and your account has been activated, the app will automatically analyze your device data and display your loan limit.

- If you qualify, select the amount you want to borrow

- Select the repayment duration 14 days or 21 days

- Then Click Apply

- Your Loan will be approved instantly and sent to your Mpesa account

How to repay Okash Loan

To pay Okash Loan follow the procedure below;

- Go to Mpesa Paybill

- Enter Paybill Number: 612224

- Account Number: Enter Mpesa phone number that you used to borrow loan

- Enter repayment amount due

- Confirm and Pay

NOTE: You can pay for someone or pay using another phone number. Over payment will be credited in your account.

Okash Loan default, CRB Listing and Clearance

If you fail to pay Okash loan within the provided period, you will be in default. This will result to your name, phone number and ID being submitted to any of the credit reference bureaus.

To have your details removed from CRB listing, repay your loan plus the fines that have accrued since your default day. Then inform Okash so that they can forward your name to CRB for clearance. This process can take upto a week.

Okash Loan customer care Contacts

You can reach Okash loan support team through the following contacts;

- Phone: 0758705699 or 0207659988

- Email: help@o-kash.com

WARNING: If you delay to pay Okash Loan, you will hate your phone. You will receive frequent sms and calls requesting you to repay your loan which is okay. If they are unable to contact you or if you happen to be off, they will call your emergency contact person that you provided. Which is also fine.

Here is where the going gets tough, if they cannot reach your emergency contact, they will randomly pick any contact from you contact list and try to reach him or her. They might land at you mother, father, brother in law, mother in law, grandfather, Ex-boyfriend or girlfriend’s contact. Anyone in your contact list. Therefore, only take Okash Loan if you can repay on time. Otherwise, your entire family including your ancestors might be contacted regarding your loan repayment delays.

Photo by Opay for Okash and modified by Loans in Kenya article editor. Join our Okash Loan discussions in the comment section below

Leave a Reply