Safaricom’s SWOT and PEST Analysis: Safaricom Limited is a public company in Kenya that is partly owned by Vodafone, the Kenyan government and shareholders. It is a dominant mobile network operator. The company was founded in the year 1993. By then, it was entirely owned by Telkom Kenya as one of its subsidiaries.

Summary About Safaricom

- Name of the company: Safaricom

- Location: Safaricom House Headquarters; Street (Waiyaki Way), Area (Westlands), City Nairobi)

- Business sector: telecommunications

- Revenue: 7 billion as per financial year ending December 2016

- CEO: Bob Collymore

- Competitors: Airtel and Telcom Kenya

- Safaricom Official website: https://www.safaricom.co.ke

- Safaricom Facebook: https://www.facebook.com/SafaricomLtd/

- Safaricom Twitter: https://twitter.com/SafaricomLtd

- Safaricom You Tube: https://twitter.com/SafaricomLtd

- Safaricom Official Contacts: PrePay: Call 100 (Free) Or +254 722 002100 (chargeable) and PostPay: 200 (Free) Or +254 722 002200 (chargeable) or Email: customercare@safaricom.co.ke

- Common Company tags: mpesa, mshwari, mobile shop, data bundles, wifi, fibre, academy, hosting, developers, financial year report,

SWOT Analysis of Safaricom

The following is the SWOT analysis for safaricom ltd

Strengths

- Experienced workforce

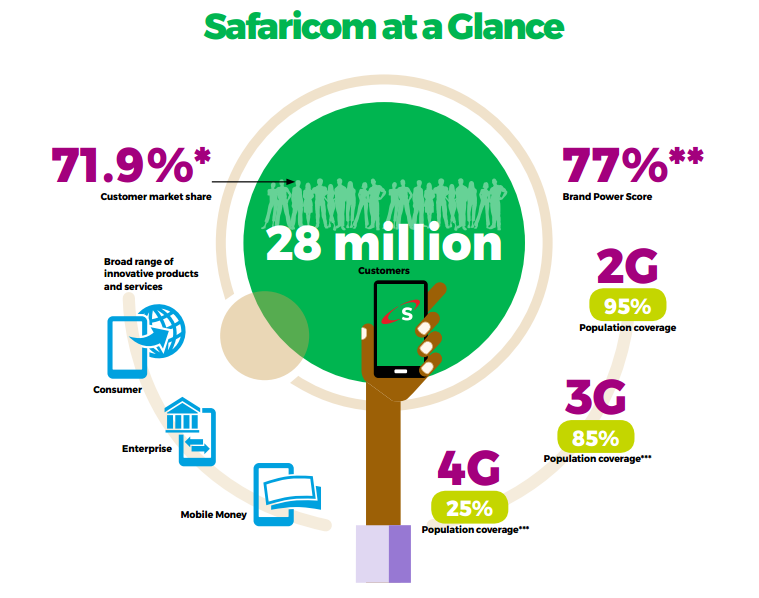

- Highest number of subscribers

- High profitability and revenue

high growth rate - Variety of products and services e.g. M-Pesa money transfer, M-kesho, M-Co-op, M-shwari

- Largest market share

Weaknesses

- Future productivity and profitability

Opportunities

- Skyrocketing demand

- Growing economy

emergence of new markets

Threats

- Political developments in Kenya

- Power shortages

- Cash flow

Pest Analysis of Safaricom

The following is the pestle analysis for safaricom ltd

Political

- Political uncertainty in the country

- Corruption

- Terrorism

Economical

- Volatile Kenyan currency

Social

- Rise in the disposable market of its operational geography

Technological

- Mobile money services

- Digitization of operations

Legal

- Strict and increased regulatory demands

Environmental

- E-waste management

- Mechanisms for alternative energy

[irp]

Swot and pestles analysis of Safaricom was last updated on (10th October 2017). Do not miss all our updates on its financial year reports.

Leave a Reply