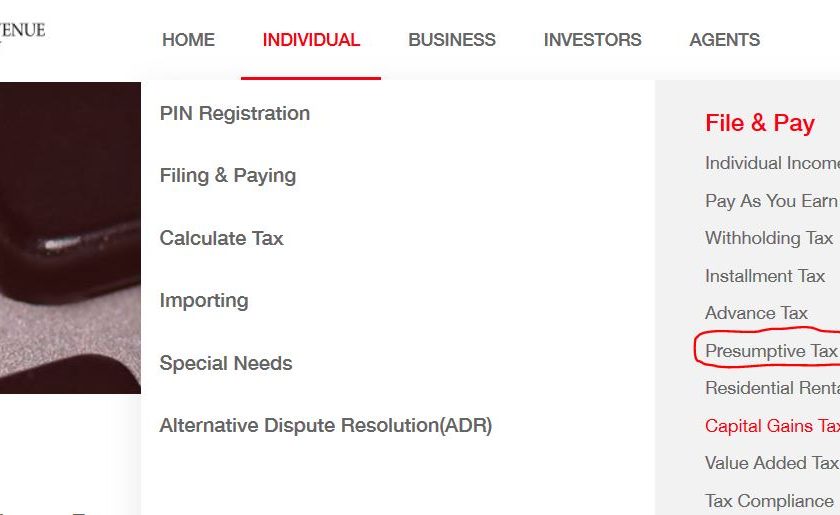

Below is a quick guide on how to Pay Presumptive Tax using KRA Itax Portal, Mpesa Paybill for those renewing their business permits or trade license issued by respective County Government.

Should you File Presumptive tax Returns?

If you run a business in any county in Kenya and you have a business permit commonly referred to as a Business license then you are required to renew it yearly and as from January 2019, you will be required to pay 15% of your business permit fee which will go to KRA. This is what is referred to as Presumptive Tax.

How do I generate a Payment Registration Number (PRN)?

In the guide below we will guide you on how to generate your Payment Registration Number through the itax portal.

We will begin by guiding you on how to generate your PRN then how to pay your presumptive tax via mpesa playbill number.

How to Pay Presumptive Tax using Itax Portal

STEP 1: To Generate PRN visit: KRA Itax Portal (https://itax.kra.go.ke/KRA-Portal/)

STEP 2: After Login or Registering, Click on PAYMENTS and then Payment Registration as indicated in the image 1 below ;

STEP 3: Verify your name and Personal Pin and then proceed to next as shown in photo 2 below;

STEP 4: Fill in your Business Details by inputting the following details as shown in photo 3 below;

- In Tax Head select (Tax Income)

- In Tax Sub Head select (Presumptive Tax)

- In Payment Type select (Self Assessment Tax)

- Then select Payment Registration

Presumptive Tax Details

- In Year select (2019)

- In County (select the County where your business is registered e.g Nairobi)

- Then select Sub County and Ward

- In Business License Registration Number (Input your Business ID)

- In Business Name enter (Your Business Name)

- In Yearly Turnover (Enter the amount your business generated in the previous year)

- In SBP Payable Value (Enter Business Permit Payment amount. This is the amount you pay for you County renewal license)

- Presumptive Tax will automatically populate how much you are supposed to pay (that is 15% of SBP Payable Value)

- Then click ADD (Do not forget to click the add button)

- Select the Mode of payment as (Cash/Cheque) if you want to pay via Mpesa Paybill

- The Click Submit

A form will load that has Payment Registration Number (PRN). (Be sure to download the form and file your returns).

NOTE: If you get the message “An error has occurred” kindly contact support with the error number for help.

Step 5: How to Pay Presumptive Tax via Mpesa Paybill Number

Top Pay Presumptive tax via Pay bill

- Go to your Mpesa Menu

- Select Lipa na Mpesa, then Paybilll.

- Enter Business Number: 572572 (this is for Kra)

- Enter Account: (Enter your Generated Payment Registration Number (PRN)A

- Amount: Enter The amount of Presumptive Tax you are supposed to pay as shown a shown in STEP 4 number (8).

- Then Pay. You can also pay via Bank.

You are done!

To Learn more about Presumptive Tax Laws, Penalties, Fines e,t,c visit: Understanding Presumptive Tax

[irp]

Do not miss all our latest updates on presumptive tax and paying methods

Leave a Reply