One of the fees you have to pay when you borrow a bank loan in Kenya is Negotiation fee. Get to understand what bank loan negotiation fees is and at what point it should be deducted.

Bank Loan Negotiation Fee Case scenario

When you visit a bank, let say Barclays, Equity or KCB bank and borrow a loan and especially a personal loan, banks do add negotiation fee and risk margin. For business, these fees are normally deducted from the borrowers account.

What is Loan Negotiation Fee?

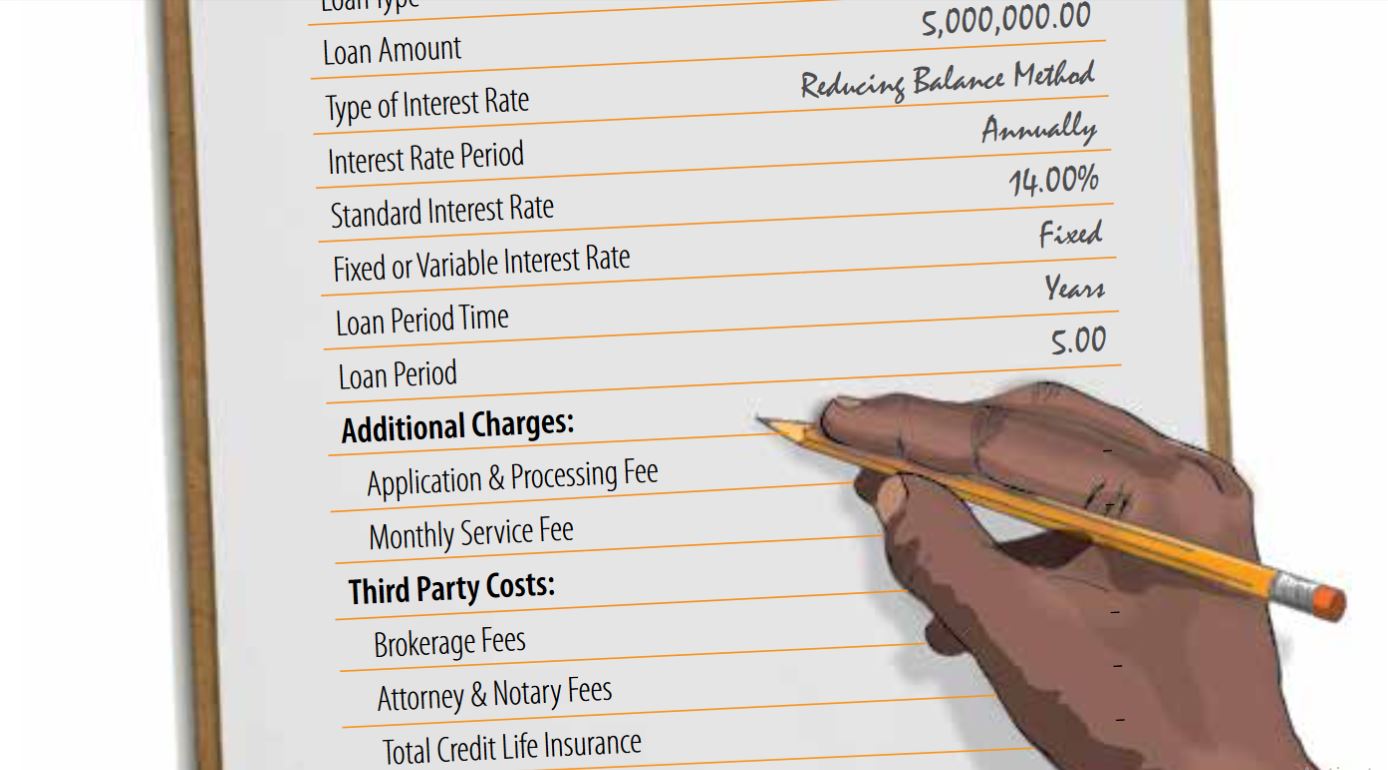

Negotiation fee is the amount of money that will be deducted or added to the loan you borrowed to facilitate the process of issuing you a loan. It is sometimes refereed to as processing fee. Almost all banks do charge negotiation fees upfront. However, some banks sum it to the loan you borrowed. For instance, if you borrowed KES. 100,000 and negotiation fee is Kenya Shilling 3,000 then your loan total is ksh. 103,000 plus other fees.

If your bank says they will charge negotiation fees, inquire from the bank manager to know the exact percentage that is charged for Negotiation fee before you take the loan.

Negotiation fee ranges from 1% to 3% of your loan.

Important! Always read your Loan offer letter or contract terms before you sign so that you can understand what you are being offered. There will also be other additional charges like Facility fee, legal fee, insurance, excise duty e.t.c. You will only have yourself to blame if you don’t read the letter of offer word by word.

Photo credit: Kenya Bankers Association and slightly modified by editor

Leave a Reply